Company van insurance explained: insuring vans in the company or director’s name

Many small UK companies run vans but are unsure whether to insure them in the company name, a director’s name or someone else entirely. This guide explains how company van insurance works, what insurers look at for ownership and main drivers, and how to arrange your insurance correctly.

When your business owns or runs a van, it is natural to ask a simple question that does not always have a simple answer:

Should the van insurance be in the company name, the director’s name, or someone else entirely?

Get this wrong and you can end up with cover that does not match how the van is really used, or with confusion if a claim ever needs to be paid. Get it right and you have a clear, honest setup that insurers can price fairly and support if something goes wrong.

This guide looks at the main options for company owned or company used vans, what insurers pay attention to, and some common setups for small firms.

It is a general overview only, not legal or tax advice. If you are unsure about your structure, it is usually worth speaking to a broker and, for tax questions, an accountant.

Who this guide is for

This article is mainly written for:

- Small limited companies with one or a few vans on the road

- Sole traders who have recently set up a company and are unsure whether to move the van into the company name

- Directors who use a van for both business and some personal use

- Businesses where more than one employee drives the same van

- Anyone looking to insure a company owned vehicle

If you run a larger fleet with many vehicles and a separate fleet policy, you will often have more formal arrangements in place, but many of the points here still apply in principle.

How company vans are usually owned and registered

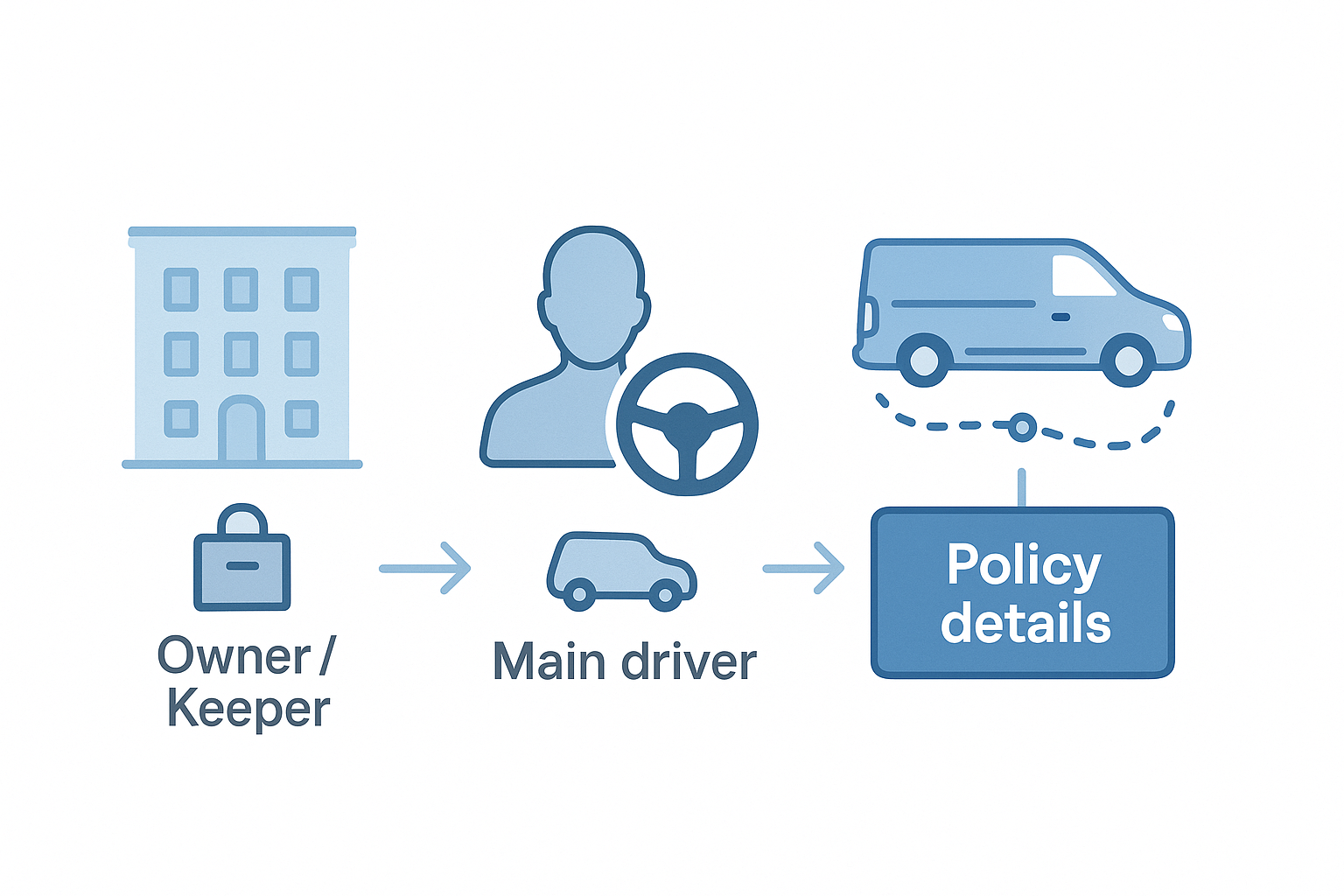

There are three separate ideas that often get mixed up:

- Legal owner: Who actually owns the van as an asset. This might be the company, a finance company, or an individual.

- Registered keeper: The person or entity recorded with the DVLA as responsible for taxing and keeping the vehicle. This is not always the same as the owner.

- Main driver or regular users: The person who uses the van most of the time, plus any other regular drivers.

Insurers ask questions about:

- Who owns the van

- Who keeps it

- Who drives it and for what kind of work

They do this so they can match the cover to the real risk, and to reduce the chance that the policy is being set up in someone else’s name just to reduce the premium.

A simple rule of thumb is that the information you give an insurer should match how things work day to day. If the company owns the van and directs how it is used, that should normally be clear on the policy.

Company name vs director name on the policy

For many small businesses there are two obvious options:

- The policy is in the company name

- The policy is in an individual’s name, often a director

Here is a simple way to think about the differences.

|

Setup |

How it usually looks |

Main points to think about |

|---|---|---|

|

Policy in the company name |

The limited company is the policyholder. Directors and employees are named or covered as drivers. |

Clear that the van is a business asset. Claims payments are usually made to the company. Can make it easier when staff use the van as part of their job. |

|

Policy in a director’s name |

The director is the policyholder. The van may be owned by the company or by the director. The company is shown as having an interest. |

Can be workable where one director is the main user and the company's leadership structure is simple. Important that ownership, keeper details and use are still described honestly and referred to the insurer. |

|

Policy in an employee’s name when the van really belongs to the company |

The employee is the policyholder, but the company owns or controls the van. |

This can raise questions. It may look like the policy is in a lower risk person’s name mainly to bring the premium down, especially if others use the van often. |

Insurers will not all treat these setups in the same way. Some are relaxed about a director being the policyholder if they are the sole director of the company. Others prefer the company to be the policyholder once the van is genuinely a company asset, if it is leased to the company, or if there are multiple directors.

What they tend to dislike is anything that looks like the risk is being shifted on paper away from the real owner or main user just to save money.

Rules insurers care about: ownership, keeper, main driver and use

Whatever name goes on the policy, insurers are interested in a few basic facts.

- Who owns the van and who keeps it: If the company has bought the van and keeps it at its premises, insurers will want that to be clear. If a director owns the van personally and keeps it at home, that should also be reflected.

- Who uses the van most of the time: The main driver should normally be the person who actually drives the van most often. Listing a director as main driver when a younger employee uses the van every day can look like fronting.

- Who else drives the van regularly: Regular drivers should either be named or, if the policy allows, fall within any driver conditions that are honestly described.

- How the van is used: Class of use still matters. For example:

- Own goods business use for tradesmen carrying tools and materials

- Courier or hire and reward use for parcel or food delivery

- Social and commuting use if the van is used outside work and for travel to and from a regular place of work

If you answer these questions in a way that matches reality, you give insurers a fair shot at pricing your risk correctly. If you bend the answers so it sounds safer or simpler than it really is, you may get a lower price at the start but more difficulty if a claim is checked.

Company vans and personal use for directors and staff

Company vans are often used for more than just jobs and deliveries. Common patterns include:

- A director taking the van home at night and using it for some personal trips

- An employee taking the van home when on call

- A pool van that lives at the yard but is used by whoever is on duty

Insurers will usually want to know if the van is used for:

- Social, domestic and pleasure trips

- Commuting to a fixed place of work

- Only business use between sites and jobs

If a van is made available for personal use by staff or directors, there can also be tax and benefit in kind implications. Those sit outside the insurance contract but can still be important in practice.

Letting family members drive a company van can raise extra questions. If the van is insured in the company name but a family member uses it mainly for private trips, it may not look like a genuine business risk. If the van is insured in a director’s name, adding family members as named drivers can be workable, but only if that matches how the van is really used and how the business is set up.

The safest approach is to:

- Be clear which people use the van and how often

- Make sure the policy wording and class of use match that pattern

- Ask the broker arranging the cover if you are unsure whether a particular kind of personal use is allowed

Common setups for small limited companies

Here are a few setups that small UK companies often run into, and some high level points on each.

Company owns and keeps the van, director is main driver

In this case it will often make sense for:

- The company to be shown as the owner and keeper

- The company to be the policyholder

- The director to be listed as main driver, with any other regular users added if needed

This keeps ownership, keeper and policyholder in line, and still makes it clear who actually drives the van most.

Director owns the van, company uses it for work

Sometimes a director already owns a van and uses it for both personal and business use. The company may pay an allowance or mileage rate but not take ownership of the vehicle.

In that case it can be more natural for:

- The director to be policyholder and registered keeper

- Business use to reflect how the van is used for company work

- Any other regular drivers who use the van for business to be named

Tax and accounting treatment sit outside the policy, so it is important to get separate advice on those.

Van used by several employees in the same business

If several employees drive the same van, especially in shifts, many insurers will expect:

- The company to be the policyholder

- The company to own or control the van

- Drivers either to be named, or to be covered within an any driver or age banded wording that is correctly described

Trying to show one employee as the main driver just to get a better price when the van is really shared heavily can cause problems later if a loss happens with someone else at the wheel.

Claims, paperwork and who gets paid if the policy is in the company name

If the company is the policyholder and there is a claim, insurers will normally deal with the company rather than an individual, even if a particular driver was at the wheel when the loss happened.

In practice this means:

- Claims payments for repairs or total losses are usually made to the company, a repairer, or a finance company with an interest in the van

- Excess payments may be handled through the company, which can then recover some or all of that amount from staff if that is agreed in their contracts

- Any disputes about who should bear the cost inside the business are usually internal matters, not something the insurer decides

If the policy is in an individual’s name and the company is shown as having an interest, insurers will often want to see that the company really is involved and that the arrangement is not just there to reduce the premium.

Either way, the more your policy documents line up with who owns the van, who uses it and who pays for it, the easier it tends to be at claim time.

Tax and benefit in kind points to be aware of

How a company van is taxed is a separate issue from how it is insured, but the two often cross over.

In simple terms:

- There can be benefit in kind implications if a company van is made available for personal use

- There can be different tax outcomes depending on who owns the van and how fuel is paid for

- Directors and employees may see tax charges if a van is treated as a perk rather than just a work tool

This guide cannot give tax advice, and the rules can change over time. If you are unsure about the tax position on a company van, it is usually sensible to speak to an accountant or tax adviser as well as getting the insurance in the right shape.

How to set up company van insurance in practice

When you are ready to get quotes for a company owned or company used van, it helps to gather a few key details first.

Information to have ready includes:

- The full legal name of the company and its registration details

- Who owns the van and who is the registered keeper

- Where the van is kept overnight and during the day

- Who uses the van and how often

- What kind of work the van is used for, including any delivery or courier work

- Whether the van is used for personal trips and commuting

A simple way to approach the quote process is:

- Decide who should be policyholder based on how the van is actually owned and used.

- Be honest about the main driver and any other regular users.

- Set the class of use to match the work you really do, not just the work you see as low risk.

- Use a comparison service such as VanCompare to see how different insurers respond to your setup.

- If the structure is unusual or the quotes look inconsistent, consider speaking to a broker who can look more closely at your case.

VanCompare can help you compare van insurance quotes from a range of providers in one place. That being said, many insurers will only offer a quote for a company owned vehicle on a case by casse referral basis. for that reason, it may be in your interest to speak with a broker who can talk you through any questions about company names, ownership and driver details before referring it off to their panel of insurers.

For a quote, please visit our main van insurance quote page here.

Company van insurance FAQs

Can a company van be insured in a director’s name?

In some cases, yes, especially where the director is the main user and the structure is simple. The important thing is that ownership, keeper details and how the van is used are described accurately. Some insurers prefer the company to be the policyholder once the van is clearly a company asset.

Does the policyholder have to be the registered keeper of the van?

Not always, but insurers will want a clear and honest explanation if they are different. For example, a finance company may be the legal owner, the company may be the keeper, and the policyholder may be the company. Problems are more likely if the policyholder has little real connection to the van.

Can employees use a company van for personal trips on the same policy?

Sometimes, as long as the policy covers social and commuting use and the drivers are correctly declared. There can also be tax implications if personal use is allowed. It is important to check both the policy wording and the tax position before treating the van as a general family vehicle.

Who gets paid if there is a claim on a company van policy?

If the company is the policyholder, the insurer will normally deal with the company or with a repairer or finance company linked to the van. If an individual is the policyholder, payments may go to them, subject to any interests noted on the policy. Keeping names and interests aligned makes this smoother.

Is it cheaper to insure a company van in an individual’s name?

Sometimes an individual quote can look cheaper, especially if the person has a strong personal driving record. However, if that setup does not match who really owns and uses the van, it can raise questions at claim time. It is usually safer to focus on a structure that reflects reality, then look for savings through things like security, mileage planning and careful driver selection.

Next steps

If your business runs a van and you are not sure whose name should go on the policy:

- Check who actually owns the van, who keeps it and who uses it most of the time

- Think honestly about how the van is used for work, commuting and personal trips

- Decide whether it makes more sense for the company or an individual to be policyholder based on that reality

- Compare van insurance quotes using those honest details

- Ask the placing broker to talk you through any parts that are still unclear

Once you have the structure set, you can then focus on the usual questions about cover level, excess and extras, knowing that the basics of who is insured to do what are on solid ground.

VanCompare Editorial Team

The VanCompare Editorial Team produces clear, practical insurance guides for UK tradesmen, couriers and small business owners. We work with FCA regulated insurance brokers and providers to translate complex insurance topics into plain English, helping drivers make informed decisions about their cover.

Where relevant, our content is checked against trusted UK sources such as the FCA, GOV.UK, the ABI and MoneyHelper to help keep it accurate and up to date.