Car vs Van Insurance: Key Differences Explained

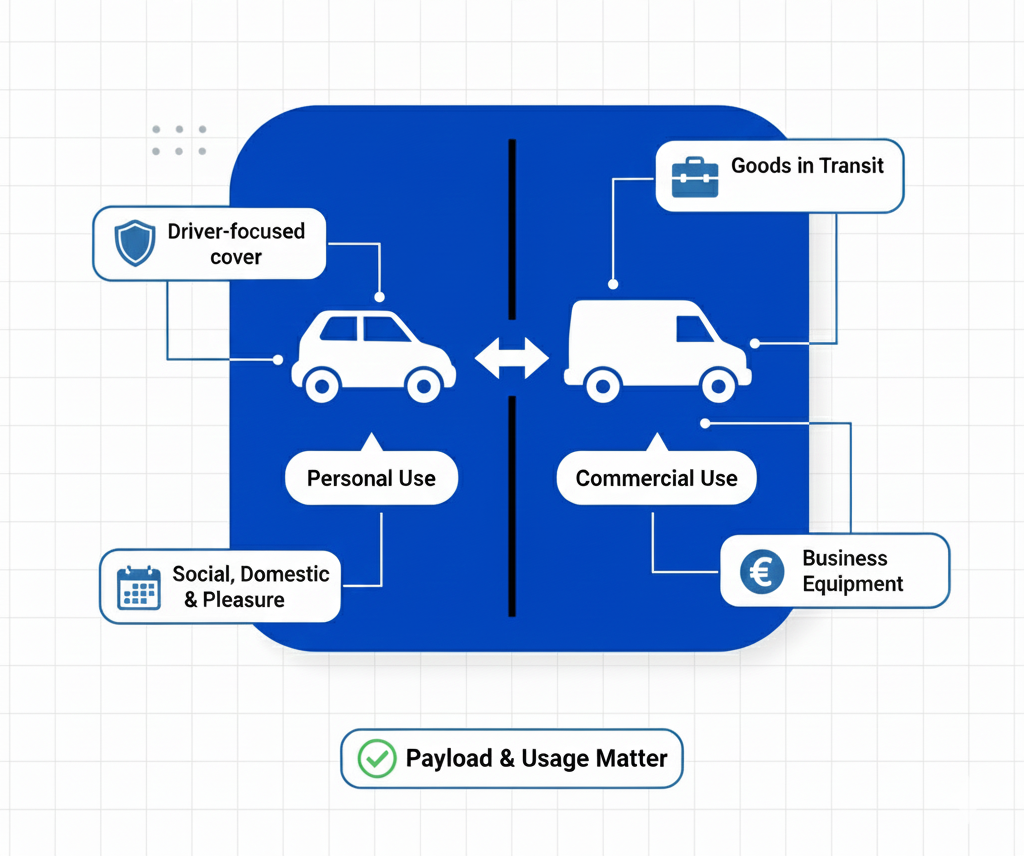

Car and van insurance sound alike, but using the wrong one could leave you uninsured. Here’s how they differ and how to pick the right cover for your vehicle.

Car and van insurance sound similar, but they serve very different purposes. Using the wrong cover could leave you uninsured and facing penalties. One of the biggest differences is price: car insurance is often cheaper than van insurance. That’s not arbitrary — it reflects differences in vehicle type, usage, and claims risk. Here’s a clear breakdown of how the two policies compare.

What Car Insurance Covers

Car insurance is designed for personal driving:

- Social, domestic, and commuting use.

- Some policies allow limited “business use” (e.g. driving between work sites), but most exclude carrying goods or tools for work.

Why it’s usually cheaper

- Cars tend to have smaller engines and cost less to repair.

- They are lighter, so accidents generally cause less severe damage.

- Usage is often shorter commutes or leisure journeys.

- Claims data shows cars have fewer and less costly claims compared with vans.

What Van Insurance Covers

Van insurance is designed for vehicles carrying goods, tools, or equipment, often for business purposes.

- Covers tradesmen, couriers, and business owners.

- Policies can also include social/domestic driving, but are built around commercial use.

- More add-on options such as Goods in Transit (GIT), Tools Cover, and Courtesy Van.

Why it’s usually more expensive

- Vans typically have larger engines and fall into higher insurance groups.

- Heavier vehicles = more costly repairs and greater accident impact.

- Higher mileage, often at peak times or in urban areas.

- Increased theft risk when carrying tools or equipment.

- Claims tend to be more complex and expensive.

Price Comparison — Key Factors

|

Factor |

Car

Insurance |

Van

Insurance |

|

Vehicle size/engine |

Smaller engines, lighter vehicles |

Larger engines, heavier vehicles |

|

Usage |

Leisure and commuting |

Business use, higher mileage |

|

Risk profile |

Lower theft risk |

Higher theft risk (tools/equipment) |

|

Claims |

Lower frequency and cost |

Higher severity and cost |

|

Premiums |

Generally lower |

Generally higher |

Risks of Choosing the Wrong Cover

- Invalid insurance: Car cover won’t protect you if you use a van for business.

- Rejected claims: Misrepresentation or non-disclosure leads to non-payment.

- Legal consequences: Driving uninsured can mean fines, licence points, or seizure of your vehicle.

How to Choose the Right Policy

- Decide whether your vehicle is mainly for personal or business use.

- If business, specify type: own goods, courier, or hire & reward.

- Compare cover levels and add-ons, not just price.

- Always buy through an FCA-authorised broker to stay protected.

FAQs

Why is van insurance usually more expensive than car insurance?

Because vans are bigger, heavier, and used for business purposes. They carry goods/tools, face higher theft risks, and cost more to repair.

Can I use car insurance for my van if it’s just for personal driving?

No. A van always requires van insurance, even if you only use it socially.

Does van insurance cover social/domestic use?

Yes. Many van policies include social/domestic driving, but you must declare it when you buy.

What happens if I use the wrong type of insurance for my van?

If your policy doesn’t cover vans or business use, it won’t protect you while driving for work. Any claim could be rejected, and you may be treated as uninsured.

Bottom Line

Car and van insurance are not interchangeable. Car insurance is cheaper because cars are lighter, smaller, and lower-risk. Vans cost more to insure because they are commercial vehicles, used more intensively, and often carry valuable goods. To stay protected — and avoid driving uninsured — always choose the policy that matches how you actually use your vehicle.

VanCompare Editorial Team

The VanCompare Editorial Team produces clear, practical insurance guides written for UK tradesmen, couriers, and small business owners. We work with FCA regulated insurance brokers and providers to translate complex insurance topics into plain English, helping drivers make informed decisions about their cover.

Our content is fact-checked against official UK sources including the FCA, GOV.UK, ABI, and MoneyHelper, ensuring accuracy and regulatory alignment.